Crypto

ColdWallets

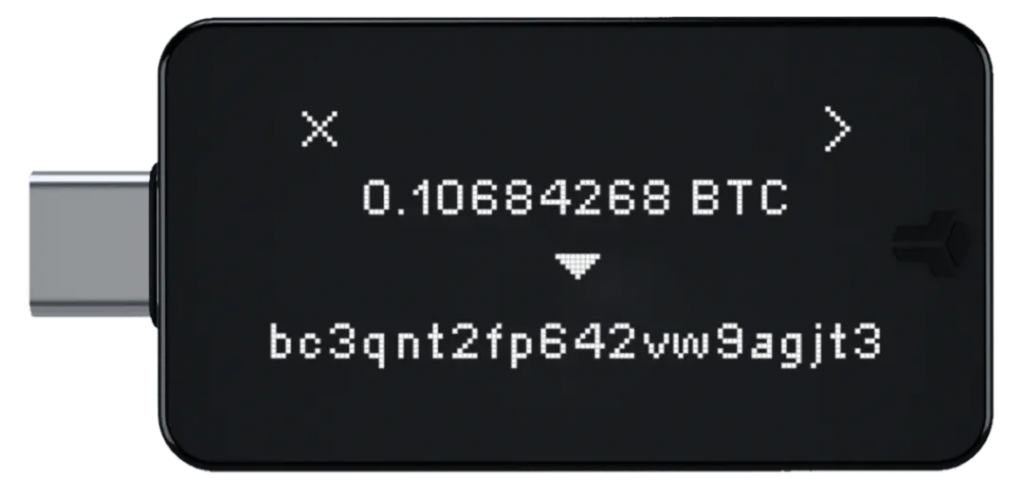

La mejor sin duda y más segura es bitbox02 por ser de codigo abierto ofrece mucha más seguridad

Comprar BTC sinKYC en exachenge es P2P (peer-to-peer) tienes que saber a quién comprar. La otra opción es comprar en cajeros de BTC que cobran un 10% de comisión con límites de 1.000€. Otra opción es encontrar a alguien que quiera venderte su criptos y le das dinero en efectivo.

Recomendaciones comprar con VPN y transferencia bancaria. También puedes buscar en youtube «como comprar bitcoin sin KYC»

Exchange KYC >Aquí la lista de exchanges<

- Binance

- Coinbase

- Kraken

- Kucoin

Mis páginas favoritas sobre mercado bitcoin

Growth Investing

Fundamentales para growth

- IPO 10-15 años

- Small-Mid Cap 150M a 20B

- PER elevado

- EPS qtr to qtrt >50%

- EPS this year > 20%

- EPS next year >25%

- Momentum Q1:10%, Q2:20%, Q3:30%

- Ventas qrt to qrt > 50%

- ROE > 15%

- Acciones en circulación free float de 20M a 150M

- Fondos institucionales

- >15$

- RS > 80

Análisis técnico

- MM 10, 20, 40, 50 semanas

- RS

- Volumen MM 20

- MM siempre en dirección ascendente

- Entradas en roturas de base, resistencias, consolidaciones o pequeñas roturas de tendencia

Trend Template to pintpoint stage 2

- 99% of supermerfomance stocks traded above 200-day MM and 96% traded above their 50-day MM

- inflow of institutional

- Stock price is above 150-day/30-week and 200-day/40-week MM

- 150-day above 200-day MM

- 200-day MM line is trending up for at least >1 month

- 50-day/10-week MM is above 150-day & 200-day MM

- Stock price is above 50-day MM

- Stock price is >30% above 52-week low

- Stock price is at least 25% of its 52-week high

- Relative strength >70

Exit from stage 2

- Plummed through 200-day/40-week MM

- Companies will anounce record earnings and try to create hype to keep their stocks up

Mercados en consolidación o Alcistas

- Rentabilidad del 20%-25%

- Stop loss 7-8%

- Cerrar una parte y dejar correr 50%

Mercados difíciles o bajistas

- Rentabilidad del 5%

- Stop loss 3%-4%

FollowThroughDay

- El día 1 cierra por encima del día anterior

- No perder los mínimos del día 1 en el día 2 y 3

- Un día con subida del >1,5% + volumen del día anterior + volumen M50 días

- Sin días de distribución (volumen superior al día anterior y cierre por debajo del día anterior

Plataformas

SEPA Key Elements SUPERPERFORMANCE STOCKS

- Trend: stock price was in a definite prce uptrend, the trend was identifiable early in the superperformance advance

- Fundamentals: improvement in earnings, revenue and margins

- Catalyst: New hot-selling product, newly awarded contract or a new CEO. Institutional interst

- Entry point: Give you at least on opportunity

- Exit points: Stablish stop-loss to force you out of losing positions to protect your account

SEPA ranking process

- Stock must first meet Trend Template

- Screen the stocks of that meet the Trend template through a filters thata are based on earnings, sales and margin growth, relative strengh, and price volatility

- Scrutinized for similarities to leadership profile whether they are in line with specific fundamental and thechincal exhibited by historical models of past superperformers

- Manual review

- Reported earnings and sales

- Earnings and sales surprise history

- Earnings per share EPS growth and acceleration

- Revenue growth and acceleration

- Company-issued guidance

- Revisions of analysts earnings estimates

- Profit margins

- Industry and market position

- Potential catalyst

- Performance compared with other stocks in same sector

- Price and trading volume analysis

- Liquidity risk

SEPA process is focused on

- Future earnings and sales surprises and positive estimate revision

- Institutional volume support

- Lack of selling versus buying

Utilizar diferentes Screeners

- relative price stregth and trend

- earnings and sales

Trading with the trend

Focus on stocks that are in a confirmed uptrend

Stage 1 consolidation

- Avoid stage 1 and learn to spot where momentum is strong during stage 2

- The stock price will move in a sideways fashion with a lack of any sustained price movement up or down

- Stock price will oscillate around its 200-day/40-week MM. Any real trend, upward or downward

- Basing stage after price has declined during stage 4

- Trying to pick a bottom is unnecessary and a waste of time

Stage 2 consolidation

- Daily and weekly price and volume chart will show big up bars representing abnormally large volume on rallies, lower volume on price pullbacks

- Stock price is above both 150-day and the 200-day MM

- The 150-day MM is above 200-day

- The 200-day MM has turned up

- A series of higher highs and higher lows has occurred

- Large up weeks on volume spikes are contrasted by low-volume pullbacks

- There are more up weeks on volume than down weeks on volume

Stage 3 Distribution

- Changing hands from strong buyers to weaker ones

- Volatility increases, with the stock moving back and forth in wider, looser swings. Although the overall price pattern may look similar to stage 2, with the stock moving higher, the price movement is much more erratic.

- There is usually a major price break in the stock on an increase in volume. Often, it’s the largest one-day decline since the beginning of the stage 2 advance. On a weekly chart, the stock may put in the largest weekly decline since the beginning of the move. These price breaks almost always occur on overwhelming volume.

- The stock price may undercut its 200-day MM. Price volatily around the 200-day/40-week MM line is common as many stocks in stage 3 bounce below and above the 200-day several times while topping out.

- The 200-day MM will lose upside momentum, flatten out, and then roll over into a downtrend.

Stage 4 Capitulation

- Lose its EPS momentum

- The vast majority of the price action is below the 200-day/40-week MM

- The 200-day MM, which was flat or turning downward in stage 3, is now in a definite downtrend

- The stock price is near or hitting 52-week new lows

- The stock price pattern is characterized as a series of lower low and lower highs, stair-steepping downward

- Short-term MM are below long-term MM

- Volume spikes on big down days and big down weeks are contrasted by low-volume rallies

- There are more down days and weeks on above-average volume than up days and up weeks on above-average volume

Graphics